Spot market freight activity continued to build during the week ending April 28 as the number of loads on the DAT network of load boards increased but a hike in truck capacity helped keep a lid on rates.

The number of available loads rose 3.1% from the week before as truck posts increased 2.6%. National van and refrigerated load-to-truck ratios dipped while the flatbed load-to-truck ratio exceeded 100 for the fifth straight week.

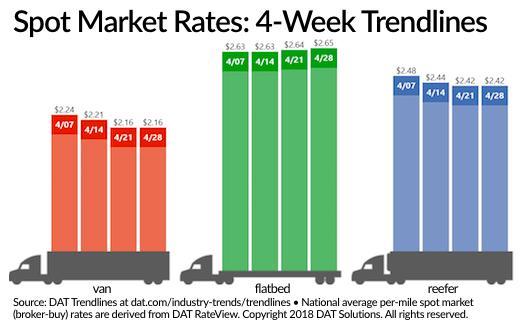

The national average van and reefer rate were unchanged at $2.16 per mile and $2.42 per mile, respectively. The average flatbed rate improved just 1 cent from the week before, as it hit $2.64 per mile.

April spot truckload rates were all higher compared to March national averages. The average van rate is up 1 cent, the reefer rate is 2 cents higher, and the flatbed rate is up 12 cents. All reported rates include a surcharge portion that fluctuates with the price of fuel, which increased to a national average of $3.16 per gallon last week.

Van load posts declined 2% last week while truck posts increased 3%. That caused the van load-to-truck ratio to dip 5% to 6.1 to 1. Key outbound markets include:

- Los Angeles: $2.35 per mile, up just 1 cent on a 9.2% increase in volume

- Seattle: $1.60 per mile, up 3 cents with a 26.6% volume increase

In contrast, several bellwether van lanes reflected weaker rates:

- Columbus, Ohio, to Buffalo: $3.78 per mile, down 30 cents but still one of the highest paying lanes into the Northeast

- Philadelphia to Boston: $3.95 per mile, down 9 cents

- Atlanta to Lakeland, Florida: $3.02 per mile, unchanged although the return was up 4 cents to $1.23 per mile

The spot flatbed market continued to surge as Cleveland, Las Vegas, Jacksonville, and Fort Worth joined Houston as volume leaders last week. Nationally, flatbed load posts increased 6% while truck posts increased less than 1%. As a result, the load-to-truck ratio increased 6% to 108 loads per truck. Outbound markets to watch include:

- Memphis, $3.54 per mile, up 16 cents

- Fort Worth, $2.38 per mile, up 9 cents

- Houston, $3.03 per mile, unchanged

- Las Vegas, $2.89 per mile, up 19 cents

Reefer load posts held steady while truck posts increased 2%. That caused the national load-to-truck ratio for reefers to decline 2%, from 8.4 to 1 to 8.2 to 1. Reefer volumes are beginning to build, however, especially in the Miami and Savannah markets, according to DAT.

Follow @HDTrucking on Twitter